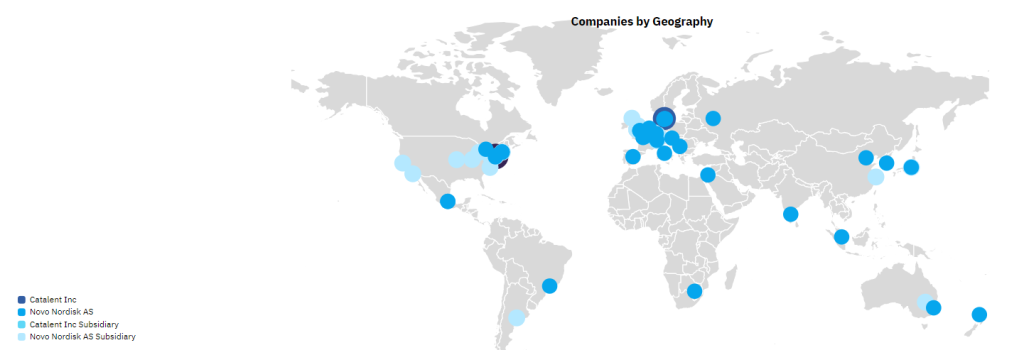

Catalent Inc (Somerset, NJ, US), a leader in the contract development and manufacturing organization (CDMO) space, announced on 5 February 2024 that it will be acquired by Novo Holdings A/S (Hellerup, Denmark), the owner of Novo Nordisk (Bagsvaerd, Denmark), which markets Ozempic/Wegovy (semaglutide).

Novo Holdings will acquire Catalent in an all-cash transaction that values Catalent at $16.5bn on an enterprise value basis.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe news has shocked the industry, and is not necessarily a sign of more mega-mergers to come, Gil Roth, President, Pharma & Biopharma Outsourcing Association (PBOA), told GlobalData PharmSource.

“Novo-Catalent is certainly a unique scenario, and I’m hard-pressed to imagine a similar take-out happening with the remaining CDMOs in the field. CDMO M&A activity has been in an overall lull, largely due to macro factors in finance and the greater economy, but we’re likely to see more announcements than the last year-plus has offered, especially if interest rate cuts begin and PE firms start unlocking more funding.”

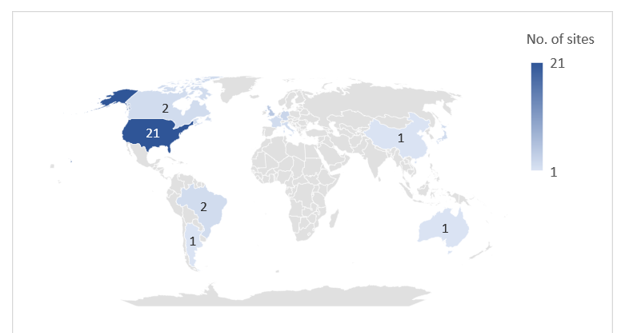

Of Catalent’s 45 global manufacturing sites, Novo Holdings intends to sell three fill-finish sites in Anagni, Italy; Bloomington, Indiana, US; and Brussels, Belgium to Novo Nordisk for its diabetes and obesity supply chain. Two of these sites are already supplying Novo Nordisk with Ozempic and Wegovy via an outsourcing contract. Novo Nordisk will pay $11bn upfront for the extra facilities. After the deal closes, the three sites will continue to honour customer contracts. Catalent has 45 pharmaceutical manufacturing sites, and a further five dealing with nutraceuticals or procurement.

See Also:

Novo Nordisk has been struggling to meet the demand for its glucagon-like peptide-1 receptor (GLP-1R) agonist products, notably Ozempic and Wegovy, and aimed to improve its supply (see Obesity Drugs Could Fuel the Next Pharma CMO Gold Rush, January 2024). This merger is a major step towards meeting that high demand.

Novo Nordisk is flush with cash these days, as is evident in Novo Nordisk’s 2023 annual earnings report. The company reported revenue of approximately DKr78bn ($11.2bn) from its diabetes care portfolio.

The merger is expected to close towards the end of 2024, subject to customary conditions, including approval by Catalent stockholders and the receipt of required regulatory approvals. The transaction is not subject to any financing contingency.

Following the closing of the merger, shares of Catalent will no longer be traded on the New York Stock Exchange and Catalent will become a private company.

Alessandro Maselli, president and chief executive officer of Catalent, said: “We look forward to benefiting from Novo Holdings’ significant resources to accelerate investment in our business and enhance key offerings as we continue to offer premium development and manufacturing solutions for pharma and biotech customers.”

Extensive manufacturing network

Novo Nordisk has been consistently bulking its manufacturing operations in the last few years, following obesity and diabetes drug shortages in several countries. In December 2023, the Danish company announced the acquisition of Alkermes‘ (Dublin, Ireland) Irish manufacturing plant in a $92.5m deal. In November 2023, the pharma giant declared plans to expand its manufacturing facility in Chartres, France to increase capacity for its GLP-1 products such as Ozempic. Novo Nordisk has also invested in its obesity pipeline this year through a $235m partnership with the Swiss biotech EraCal Therapeutics (Zurich, Switzerland).

The majority of Catalent’s manufacturing sites are in the US and Europe; 12 of these sites have active pharmaceutical ingredient (API) biologics (cell, gene, vaccine, and virus) capabilities and 20 sites offer containment capabilities for highly potent drugs. Catalent’s three injectable fill-finish sites that are being sold to Novo Nordisk all have commercial dose and packaging services, and the Bloomington site is also capable of producing biologic APIs. GlobalData’s Drugs by Manufacturer database indicates that Catalent and its subsidiaries are involved in the production of more than 206 marketed innovator and biosimilar drugs (including 46 biologics). Catalent is a major CDMO player with a large number of contracts with big pharma.

Related Company Profiles

Catalent Inc

Novonor

Novo Nordisk AS